Revolutionizing Debt Settlement Through Data

DSI has been a beacon in the debt settlement data sector since 2009, offering unparalleled insights and strategies with our innovative DSI Watch Program. We are the only data solution to offer identification as a standalone service. The team has built strong relationships with DSCs and industry associations.

Who we are

Economic Insights

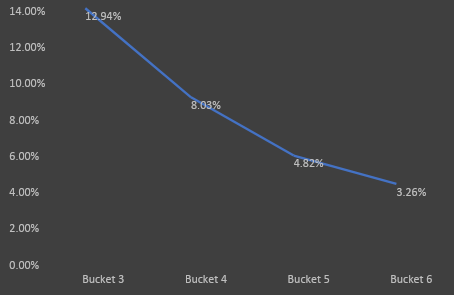

A review conducted at the end of Q1 2023 showed that the debt settlement space has grown by 50.23%. Additionally, consumer enrollment is happening earlier in the delinquency stage. In fact, 2019 pre charge off data showed that 29.05% of consumers were already actively enrolled in a debt settlement program within buckets 3-6 with 12.94% residing in bucket 3.

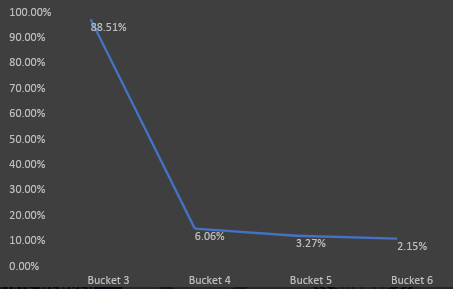

Pulling the same data today we find that this number is now 99.99% within the same buckets and an astonishing 88.51% residing in bucket 3.

These percentages do not consider consumers who are enrolled but are not delinquent.

The Future of the Debt Settlement Industry

As debt trends evolve, the industry is poised for substantial growth, marking a new era in debt settlement services. With the current household debt trend, charge-offs, delinquency rates, and debt settlement data suggest that the debt settlement industry is poised to resume its longer-term growth trend.

Our Five-Step Process

Step One

Identification

Advanced tracking techniques.

Step Two

Documentation

Authorization management.

Step Three

Negotiations

Effective creditor interactions.

Step Four

Payment

Flexible payment handling.

Step Five

Correspondence

Efficient communication strategies.

By utilizing DSI you will experience a new level of operational efficiency and compliance.

Identification Process & Security

Our commitment to data security is paramount, backed by rigorous protocols and AWS infrastructure for unmatched data safety.

Operational Efficiency & Cost Savings

With DSI, expect to free up personnel resources while improving bottom line results, leading to a more efficient processes.

ROI with DSI

Investing in DSI goes beyond cost savings—it’s about enhancing security and ensuring compliance for a solid return on your investment.

Association and Affiliations.

DSI is proudly associated with AADR, CDRI, and IAPDA, maintaining leadership in FTC compliance and industry best practices. DSI has achieved certification status with IAPDA.

Advance your debt settlement strategy with DSI

Contact Us: info@dsinfobank.com

1 (855) 374-2265